Lodging/Hotel/Auto-Rental Merchants

How does credit card processing impact lodging/auto-rental merchants?

Why are Lodging/Auto-Rental merchants different?

Many merchants and customers are unaware that Lodging and Auto-rental companies have different requirements for credit card processing. You may be asking yourself… why? The main reason is due to the fact that these merchant types allow for credit cards to have extended authorizations. Think about the last time you stayed at a hotel. One of the first things you’ll be asked for is a credit card to keep on file. And, if you pay attention closely to your credit card account, you’ll notice that the hotel will initially authorize your card immediately, upon check-in. You aren’t fully charged, but the authorization “sits” on your card, until the hotel completes the sale. You may stay for a week, or more! In a normal credit card environment, a standard authorization would have expired after a week or two, leaving the merchant with much higher credit card processing fees. That’s not a good thing.

The card associations (Visa/MC/Discover/Amex) recognize that penalizing a lodging merchant for the very nature of how they do business doesn’t make sense – so they’ve created a special, unique program that’s designed only for lodging/auto-rental merchants, so that these merchants can authorize a credit card, but not “capture” the final sale until many weeks later.

How does this impact me, the Merchant?

In short – you have to make sure that as a lodging merchant, you have the proper hardware/software to accommodate for the additional information required to process these sales. On every transaction, your terminal/software will be communicating additional information to your customer’s issuing bank, and as such, you have to make sure that your terminal has the capability to handle this type of application. Dharma deploys Lodging applications – special versions of a terminal’s programming, which ensures you’re sending the proper information to your customer’s banks on each sale, and allows you access to the lowest possible interchange rates.

Many lodging/auto-rental merchants will opt to use a specialized lodging/rental gateway that’s designed specifically for the lodging industry. We can integrate with almost all of them.

There are very few terminals on the market that allow for lodging applications. To take lodging payments with Dharma, you’ll be required to use the First Data FD-150. You can read more about the FD-150 here. This terminal allows you to manage the “check-in” and “check-out” process for your guests, so that getting low rates is built into your sales process.

How much different is the sale process?

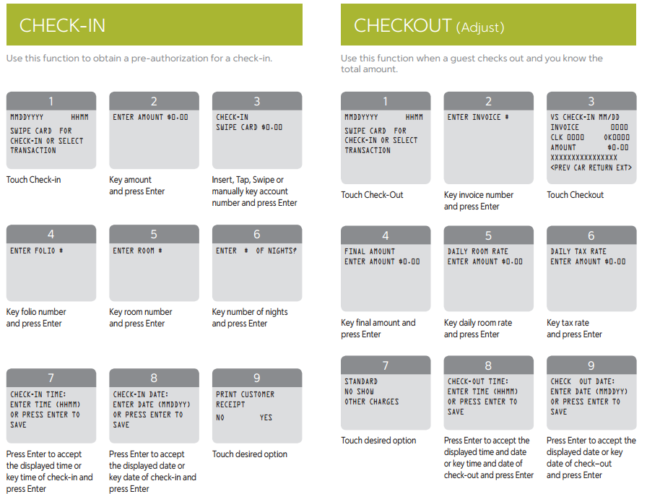

The main difference is that with a lodging application, your Dharma terminal will always expect you to be initiating or completing a stay. As such, the main screen of the terminal won’t prompt you for a “sale” or “refund,” but instead will prompt you to “check in” or “check out” your customers. This is designed with the card-associations in mind. By including the check-in and check-out dates with the transactional data, you ensure that the customer’s issuing bank gets all of the data they need to allow you to keep an authorization open. It also ensures you’ll be collecting all required information should you get a customer dispute down the line. By using the correct application, you allow Dharma to help protect you against potential chargebacks!

Here are the basic steps for a lodging transaction:

- Press CHECK-IN on the touchscreen

- Enter amount, press enter

- Insert card and leave it in the terminal for the duration of the following steps

- Input Clerk ID – any value you want to assign

- Input Folio # – any value you want to assign

- Input Room #

- Input # of nights

- The terminal will begin processing the sale and a receipt will print. You’ll notice on the receipt “Credit Card Check-In”