Small Business & Retail Rates

Save on Small Business, Retail, and Service Provider Rates

0.15% + $0.08/transaction

above Interchange

Keeping Your Costs Low

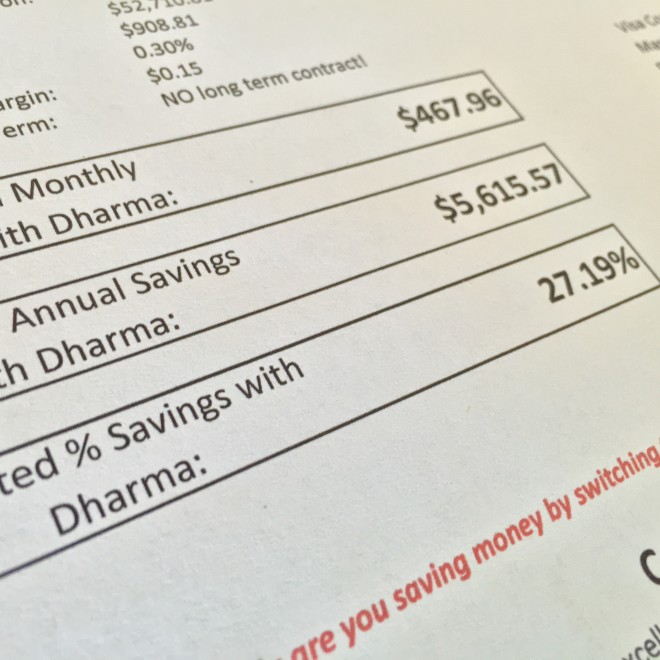

Dharma works with thousands of small business, retail, and service provider merchants who need low rate credit card processing. (Learn about who we work best with, here). That’s why we offer a low merchant rate, with fixed margins of 0.15% and $0.08 per transaction above Interchange for storefront payment processing fees. Plus, no long-term contracts! Before signing up, we’ll run a free cost analysis against your current provider to ensure you’re getting the lowest possible and best rate merchant services. Since we only operate on the Interchange-plus pricing model, you always get the lowest rates, and our margins are clearly spelled out.

- All accounts include free access to MX Merchant, including a Virtual Terminal and mobile app.

- Low, fair terminal pricing with no long-term leasing

- No annual merchant service fees, monthly minimums, or hidden fees

- Dharma operates on the TSYS or First Data credit card processing networks

- High-Volume rates for merchants processing over $100,000 per month

How much will I pay on a $100 sale? See sample rates for popular card types below.

Visa Reg. Debit

| Interchange | 0.05% + $0.22 |

| Assessment Fees | 0.13% + $0.02 |

| Dharma Margins | 0.15% + $0.08 |

| Total Fees (per $100 sale) | $0.65 or 0.65% |

Visa CPS Retail

| Interchange | 1.51% + $0.10 |

| Assessment Fees | 0.14% + $0.02 |

| Dharma Margins | 0.15% + $0.08 |

| Total Fees (per $100 sale) | $2.00 or 2.00% |

Visa Rewards 1

| Interchange | 1.65% + $0.10 |

| Assessment Fees | 0.14% + $0.02 |

| Dharma Margins | 0.15% + $0.08 |

| Total Fees (per $100 sale) | $2.14 or 2.14% |

Mastercard Merit 3

| Interchange | 1.58% + $0.10 |

| Assessment Fees | 0.12% + $0.02 |

| Dharma Margins | 0.15% + $0.08 |

| Total Fees (per $100 sale) | $2.05 or 2.05% |

Mastercard World Elite Merit 1

| Interchange | 2.50% + $0.10 |

| Assessment Fees | 0.12% + $0.02 |

| Dharma Margins | 0.15% + $0.08 |

| Total Fees (per $100 sale) | $2.97 or 2.97% |

American Express Rates

| American Express works differently! | Click here for rates |

We believe in full disclosure here.

| Fee | Dharma’s cost |

| Monthly Fee | $20/month |

| Interchange+ Margins (Visa/MC/Disc) | 0.15% + $0.08/authorization |

| Interchange+ Margins (AMEX) | 0.25% + $0.08/authorization |

| High-Volume (over $100k/mo) Margins | 0.10% + $0.08/authorization |

| Interchange / Card Assessment Fees | Passed-through at cost |

| Closure Fee | $49 |

| AVS Fee | None! |

| Batch Fee | None! |

| PCI Compliance | None! |

| Chargebacks | $25/instance |

| Virtual Terminal | Included for Free |

| Mobile Processing | Included for Free |

| Terminals, and Clover POS | Available |

Interchange-plus pricing.

No surprises, 100% transparency.

This is the fairest pricing model in the industry. Our margins are flat and fixed, so you always get a fair deal. No long-term contracts, no hidden fees.

What’s Included in a new Dharma account?

Dharma provides you both fair terms and the tools you need to accept payments with ease. All accounts come with access to MX Merchant, including:

What does Dharma NOT charge?

There are so few fees that Dharma charges, sometimes it’s easier to list off the things we DON’T charge! Here’s a full list of fees you won’t see at Dharma! No nickel-and-dime games here. We want you to choose us for simplicity, transparency, and low rates.

| Fee | Does Dharma charge it? |

| Annual Fees | No! |

| Monthly Minimum | No! |

| PCI Compliance Fee | No! |

| Early Termination Fee | No! |

| Batch Fee | No! |

| AVS Fee | No! |

| IRS / Regulatory Fee | No! |

| Gross Funding Fee | No! |

| Bank Change Fee | No! |

| Account Update Fee | No! |

| Virtual Terminal Fee | No! |