Nonprofit Rates

Reduced Rates Just for Nonprofits

0.10% + $0.08 (Storefront)

0.10% + $0.11 (Virtual)

above Interchange

We’re committed to helping nonprofits keep their costs low. That’s why we offer reduced pricing for registered nonprofit organizations no matter how much or how little you are processing.

Pricing: We believe in full disclosure.

| Fee | Dharma’s cost |

| Monthly Fee | $15/month |

| Interchange+ Margins V/MC/D (storefront) | 0.10% + $0.08/authorization |

| Interchange+ Margins V/MC/D (virtual) | 0.10% + $0.11/authorization |

| Interchange+ Margins Amex (storefront) | 0.20% + $0.08/authorization |

| Interchange+ Margins Amex (virtual) | 0.20% + $0.11/authorization |

| Interchange / Card Assessment Fees | Passed-through at cost |

| Closure Fee | $49 |

| AVS Fee | None! |

| Batch Fee | None! |

| PCI Compliance | None! |

| Chargebacks | $25/instance |

| Virtual Terminal | Included for Free |

| Mobile Processing | Included for Free |

| Gateway (if needed) | $10.00 / month + $0.05 / transaction |

| Terminals (if needed) | Starting at $295 |

What does Dharma NOT charge?

There are so few fees that Dharma charges, sometimes it’s easier to list off the things we DON’T charge! Here’s a full list of fees you won’t see at Dharma! No nickel-and-dime games here. We want you to choose us for simplicity, transparency, and low rates.

| Fee | Does Dharma charge it? |

| Annual Fees | No! |

| Monthly Minimum | No! |

| PCI Compliance Fee | No! |

| Early Termination Fee | No! |

| Batch Fee | No! |

| AVS Fee | No! |

| IRS / Regulatory Fee | No! |

| Gross Funding Fee | No! |

| Bank Change Fee | No! |

| Account Update Fee | No! |

| Virtual Terminal Fee | No! |

Get a free consultation from Dharma

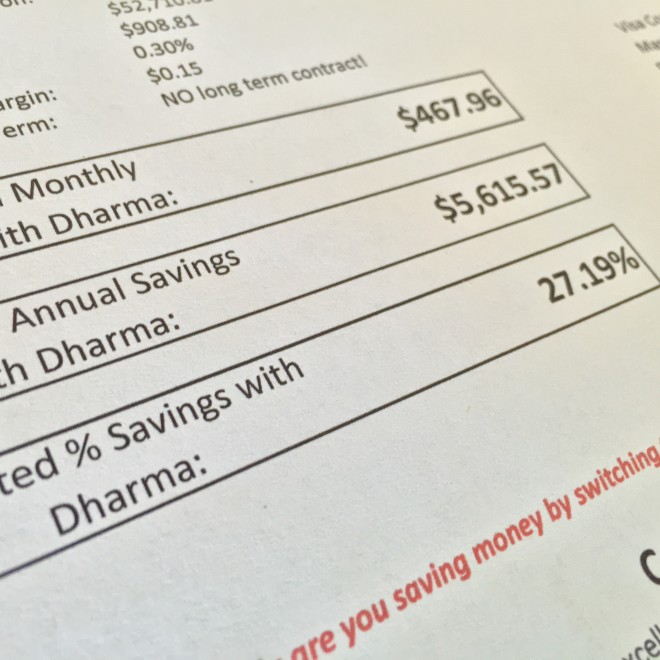

Tell us how to contact you, and a little about your business, and we’ll be happy to give you a free evaluation of your fees, and let you know how you can save with Dharma

What’s Included in a new Dharma account?

Dharma provides you both fair terms and the tools you need to accept payments with ease. All accounts come with access to MX Merchant, including:

When you work with us, you have a partner you can trust.

- Quick & easy paperless sign up.

- Guaranteed 48 hour funding, Next-Day funding offered for retail merchants.

- Free consults with trained, non-commissioned staff to help meet your needs.

- Simple & hassle-free terminal setup and gateway creation.

- Your support questions are answered by real people.

- 24-hour tech support.

Top Frequently Asked Questions

Read our most common FAQs, and browse our Knowledge Base to learn more.